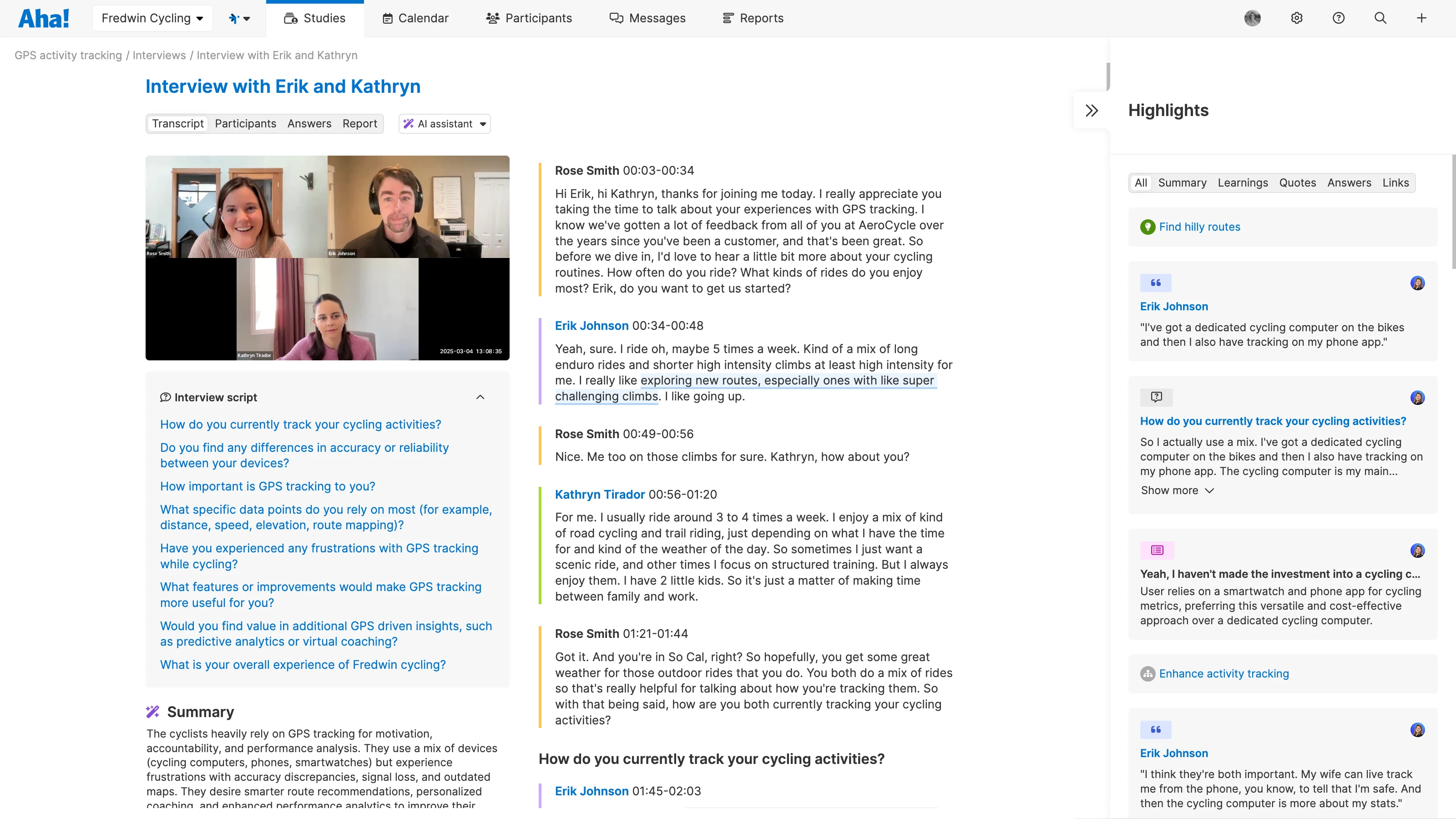

You can upload recordings and extract insights from customer interviews using Aha! Discovery.

In this guide, you will learn the fundamentals of conducting primary research so you can better understand the folks you are trying to help. You can try seven customer research templates to help you experiment with different methods and save time in the research process.

Keep reading or use the following links to jump ahead to a specific section:

Why should you do customer research?

Customer research is an essential component of product strategy — alongside competitor analysis, market research, and overall business needs. The insights you glean from meeting and surveying customers help to shape your strategic initiatives, ensuring that your team is poised to deliver what people really want from your product.

A key reason to perform customer research is to gain new perspectives on your product. Your customers may tell you things you never realized — hidden problems, unique ways of completing tasks, and even alternate use cases. What you believe matters most about your product may not even be on your customers' radar.

Let's say your product has a reporting feature with low usage. Your team decides to give the reporting interface a major upgrade. You spend the time and resources to build these updates — only to scratch your head when there is no uptick in usage. What went wrong?

If you breezed past talking to your customers, it is possible that the interface was not the factor keeping them from engaging. Maybe they prefer to use a separate reporting tool — in which case, an integration capability would have been a much more valuable feature to build.

Customer research helps you avoid spending time solving problems that do not exist — and highlights the ones that are real and deserving of your attention. This way, you know where to focus your efforts for the best chance of making your customers happy and meeting business goals.

Related:

Top

How much customer feedback is the right amount?

The short answer? It depends. Your specific goals, the scope of your research, and the stage of your product's development all play a role. Here are some things to keep in mind when determining the right amount of customer feedback to collect:

Understand your goals

Are you looking to validate a new product idea or improve an existing product? Do you need to better understand customer pain points or gather usability insights? These answers will shape your product development goals and dictate the depth and breadth of feedback required.

Define your sample size

Consider the size of your target audience and customer base. In some cases, a smaller sample size can provide valuable insights, especially if you are conducting in-depth qualitative research. For quantitative research, a larger sample size might be necessary to ensure statistical relevancy.

Ensure diversity of perspective

Aim for variety in your feedback pool. Different demographic groups, usage patterns, and customer segments can provide a more comprehensive understanding of customer needs and preferences.

Include a mix of feedback channels

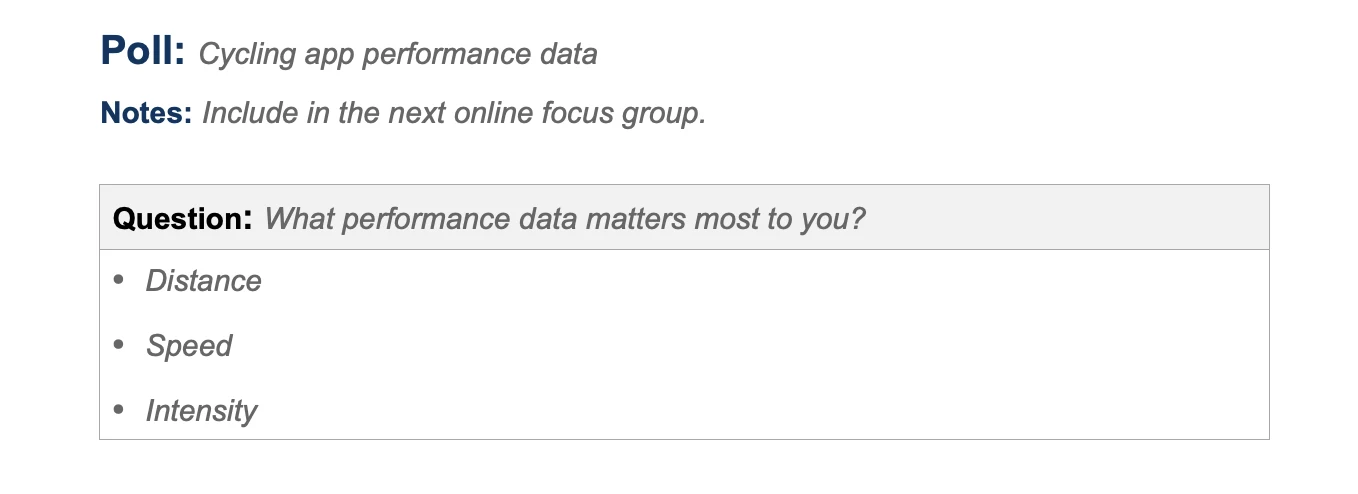

Analyzing feedback from different channels can provide unique perspectives and insights. Experiment with a variety of feedback methods and channels — such as releasing surveys, conducting interviews, and reviewing your social media and customer support interactions.

Consider resource constraints

Think about the time, budget, and staff you have available for collecting and analyzing feedback. Balance the scope of your research with what you can realistically manage.

Remember, customer feedback is often collected in iterations. Start with a small group of users for early insights, then expand your feedback pool as you make improvements. Each iteration helps you refine your product and strategy.

And while quantity matters, the quality of feedback is crucial. Sometimes a few detailed, insightful responses can be more valuable than a large number of superficial ones.

Primary vs. secondary customer research

Product managers rely on both primary and secondary customer research to gather meaningful input. Briefly, the difference is:

Primary customer research involves collection data firsthand via interviews, focus groups, surveys, and other methods.

Secondary customer research comes from external sources like analyst reports and third-party surveys.

Both have value. Secondary research can highlight market trends and demographic shifts. But primary research gives you direct access to what your customers think, feel, and need — and is typically more actionable for making product decisions.

Primary research shows up in different forms. You might spot themes across feedback in your ideas portal or notice something unexpected in your analytics. And one-on-one conversations with customers can reveal details you would not uncover at scale.

At Aha!, we treat all of this as part of a connected system. Aha! Ideas helps you collect and analyze feedback at scale. Aha! Discovery lets you go deeper — plan research studies, capture insights, and connect what you learn directly to your roadmap. Together, these tools support a continuous discovery process so you can move from raw input to strategic action.

Related:

Top

How to conduct customer research

On a basic level, customer research entails reaching out to current or potential customers and gathering feedback from them via direct conversations or more indirect methods (like online surveys). Advanced tools such as customer interview management and idea management software can certainly augment your approach — but are not necessary to get started.

Follow these steps to conduct your own primary customer research:

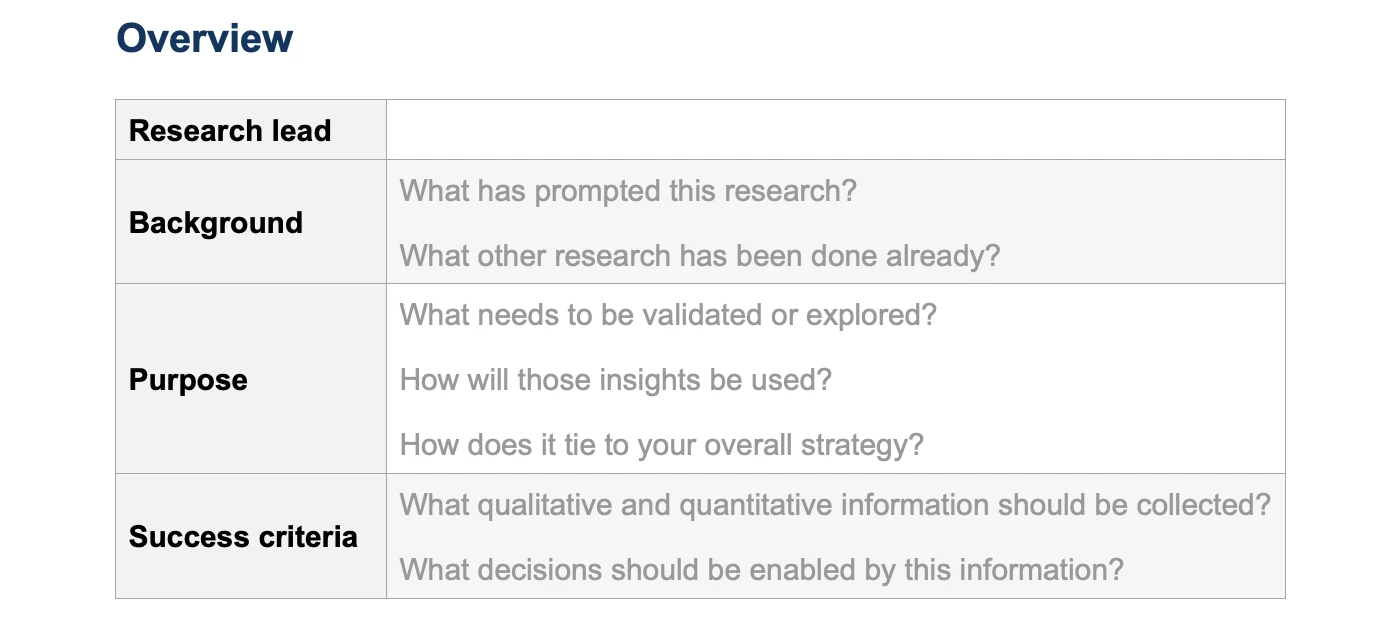

1. Define your objective

Outline your research goals and determine what it is you really want to learn. For example, your objective could be to learn broadly about your customers' business goals or gain a deeper understanding of their experience with a specific feature set.

2. Decide which customers to contact

Your objectives will help you decide who to speak with — especially if your product caters to a diverse group of customers. Think about current and potential customers and form a list of people to reach out to.

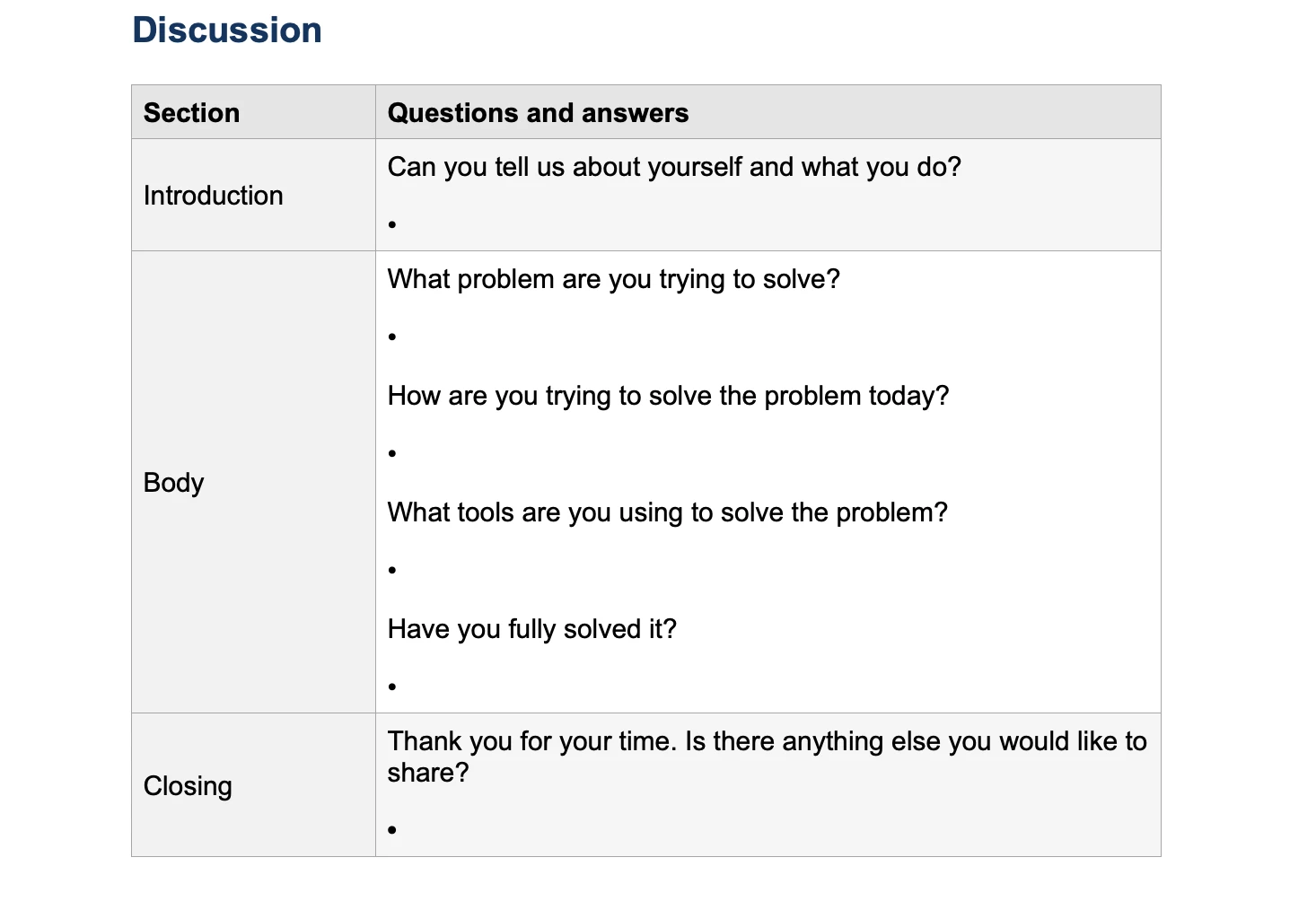

3. Prepare

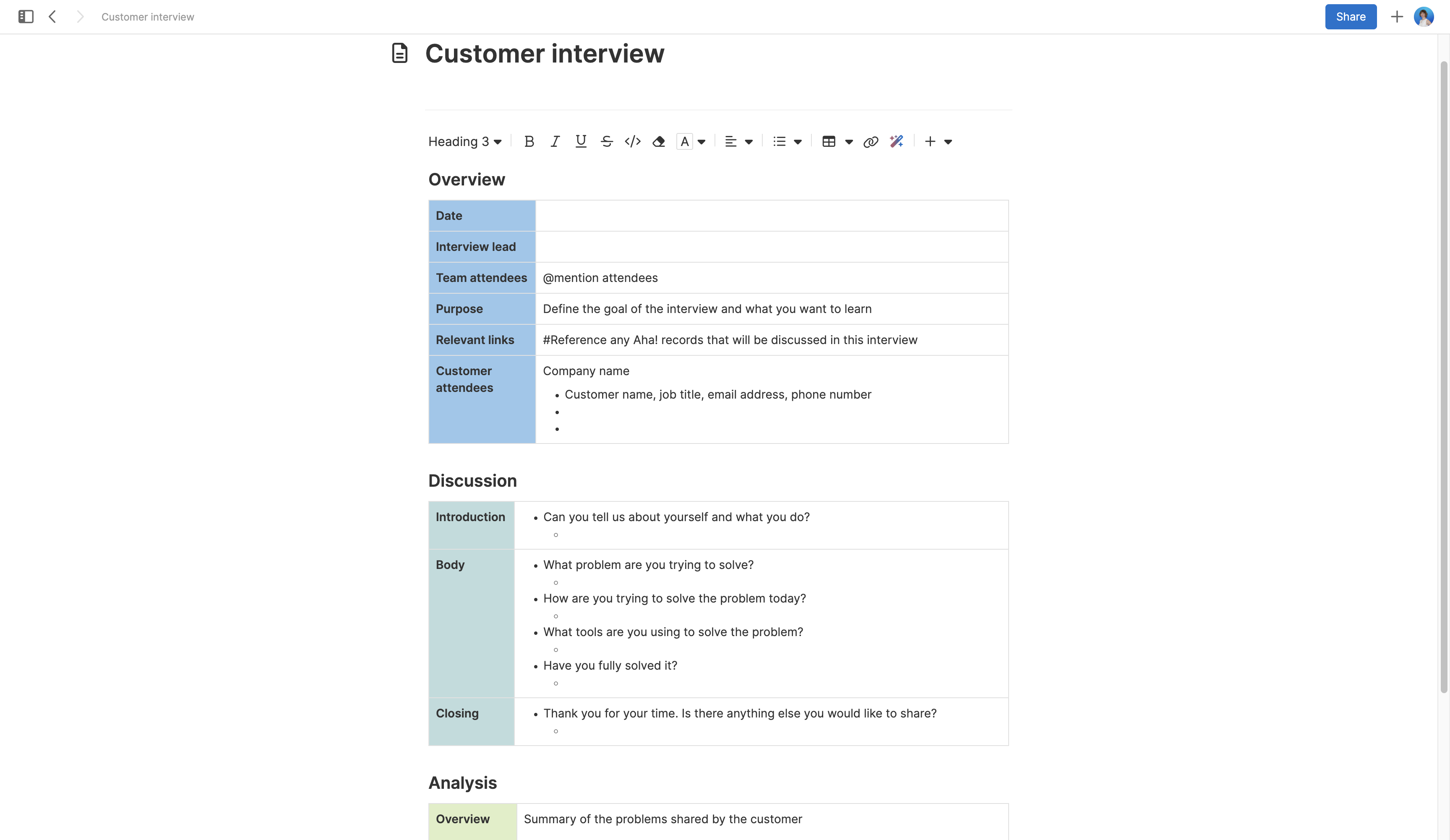

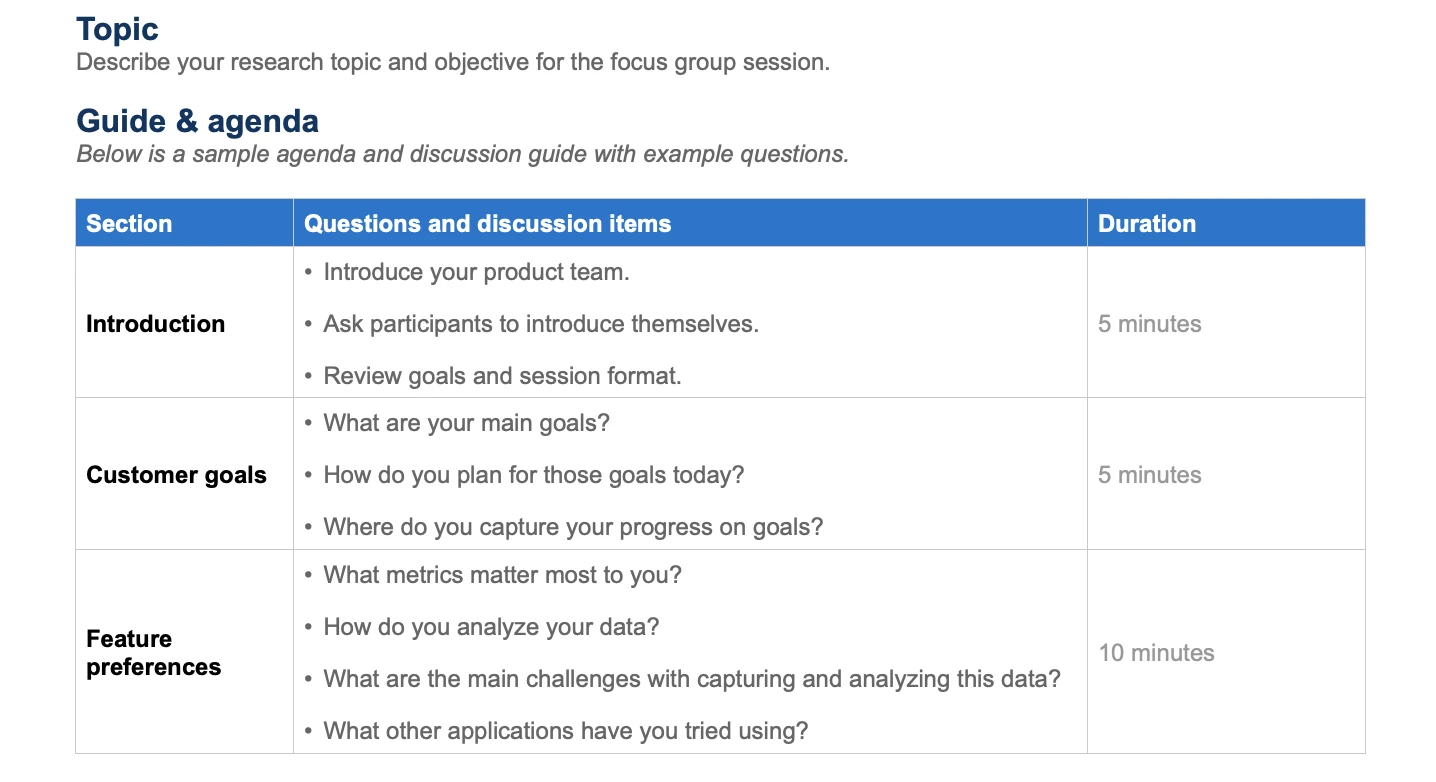

If you are leading an interview or focus group, meet with your product teammates to prepare your questions. Keep in mind you may need to coordinate with other team members who want to sit in on discussions. If you are conducting a survey, build it — then decide how and when to distribute it.

4. Start your research

Conduct your interviews or hit "send" on your survey When talking directly with customers, remember to listen more than you speak. Ask meaningful follow-up questions to encourage deeper thinking and discussion.

5. Analyze, summarize, and share your findings

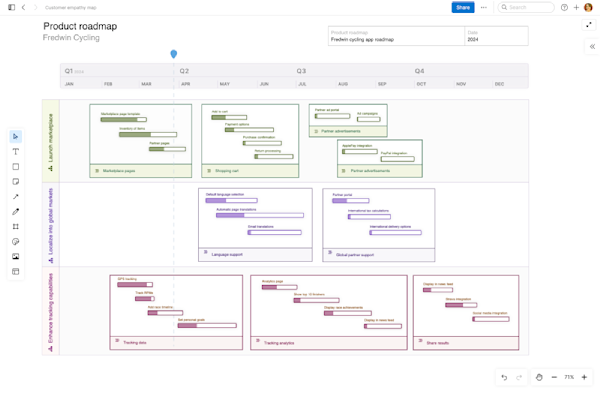

Look for trends in the feedback you received. What did customers agree on? What were the most popular ideas or recurring pain points? Find common threads and share the findings with your team. Together, you can discuss and prioritize the customer ideas that support your overall goals — and promote those ideas to your product roadmap.

6. Repeat

Customer research is an ongoing part of product management. You will need to collect feedback from many customers to make informed product decisions. And with every new product launch or major release, you may need to start fresh with a new objective and customer set.

Because it is ongoing, it helps to keep all of your customer research organized. You want to be clear on how your findings will inform the features you develop. For example, the Research tab in Aha! helps you collect whiteboards, interview notes, and ideas right on feature cards.

Related:

Top

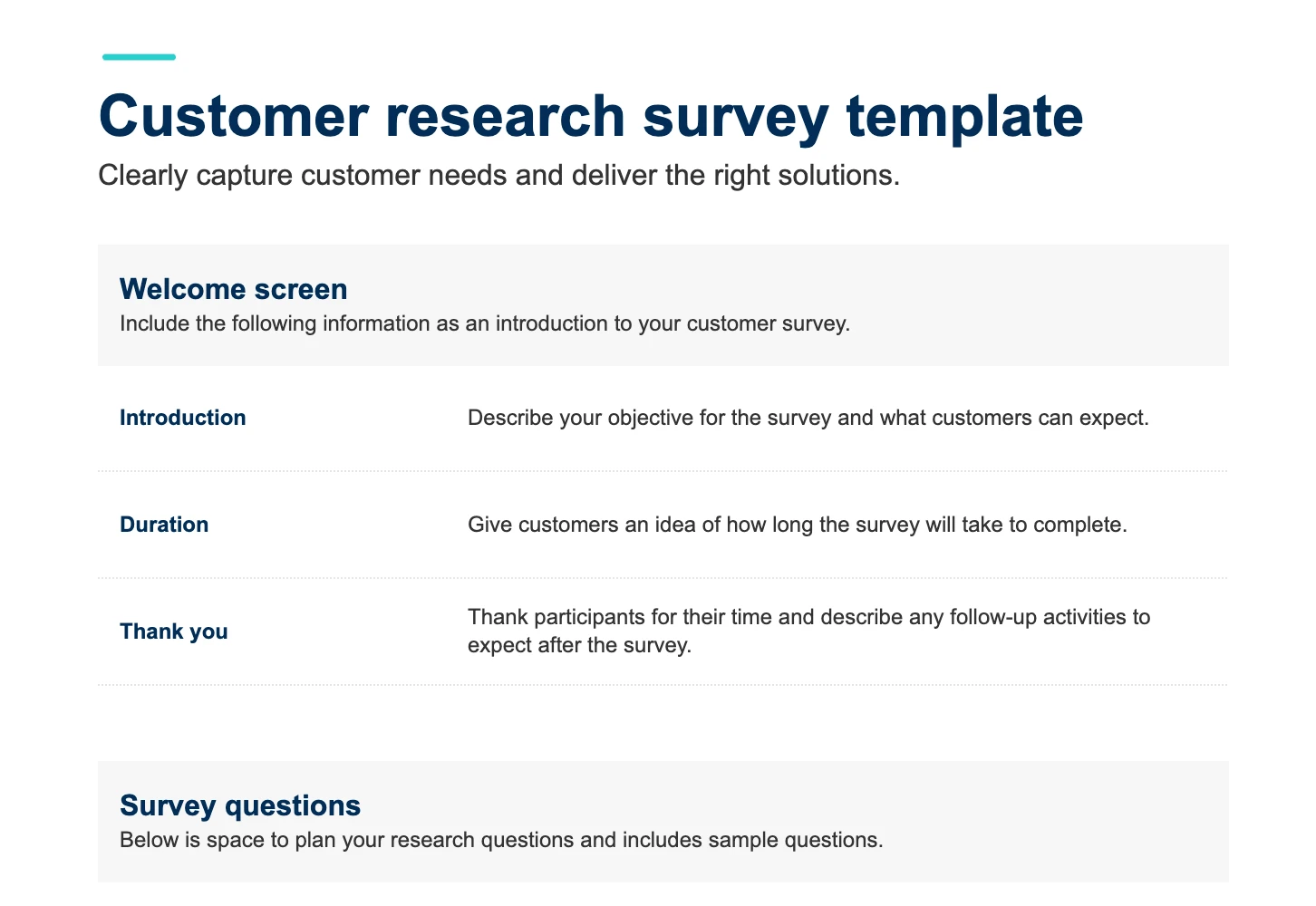

Get started with customer research templates

Customer research templates offer a simple way to start discovering who your audience really is and what matters to them. Using templates helps you add much-needed structure to your customer research process. Below, you will find an assortment of templates to try — from planning to interviews, surveys, and summarizing your findings.