How to build a customer database for product discovery

Lay the foundation for consistent user research

Last updated: May 2025

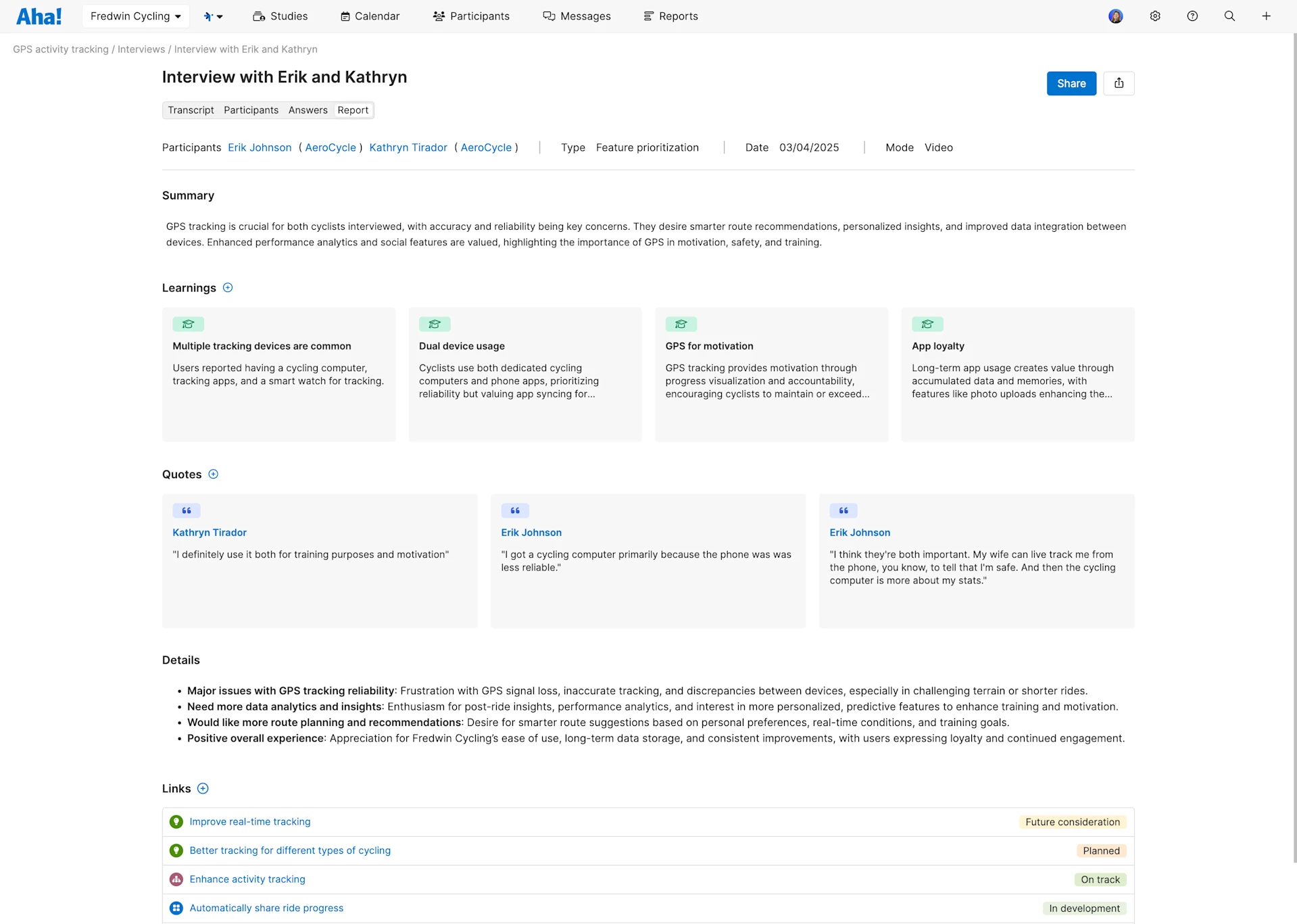

Discovery starts with conversation. You talk to customers and hear their stories — what they love, where they struggle, and what they wish you would fix already. These conversations help you validate your plans and uncover insights you would never find in a report. They are the foundation of any successful user interview program.

But when you do not have a system for managing that work, things get messy. Notes vanish. Follow-ups overlap. And the same customers answer the same questions again and again. Without a central place to track participants and organize insights, it is easy to miss valuable opportunities or wear out your most engaged customers.

That is where a customer research database comes in. It gives you a structured way to track who you speak with, organize what you learn, and keep discovery work connected to product planning. It also helps you build and maintain a dedicated interview panel for consistent research.

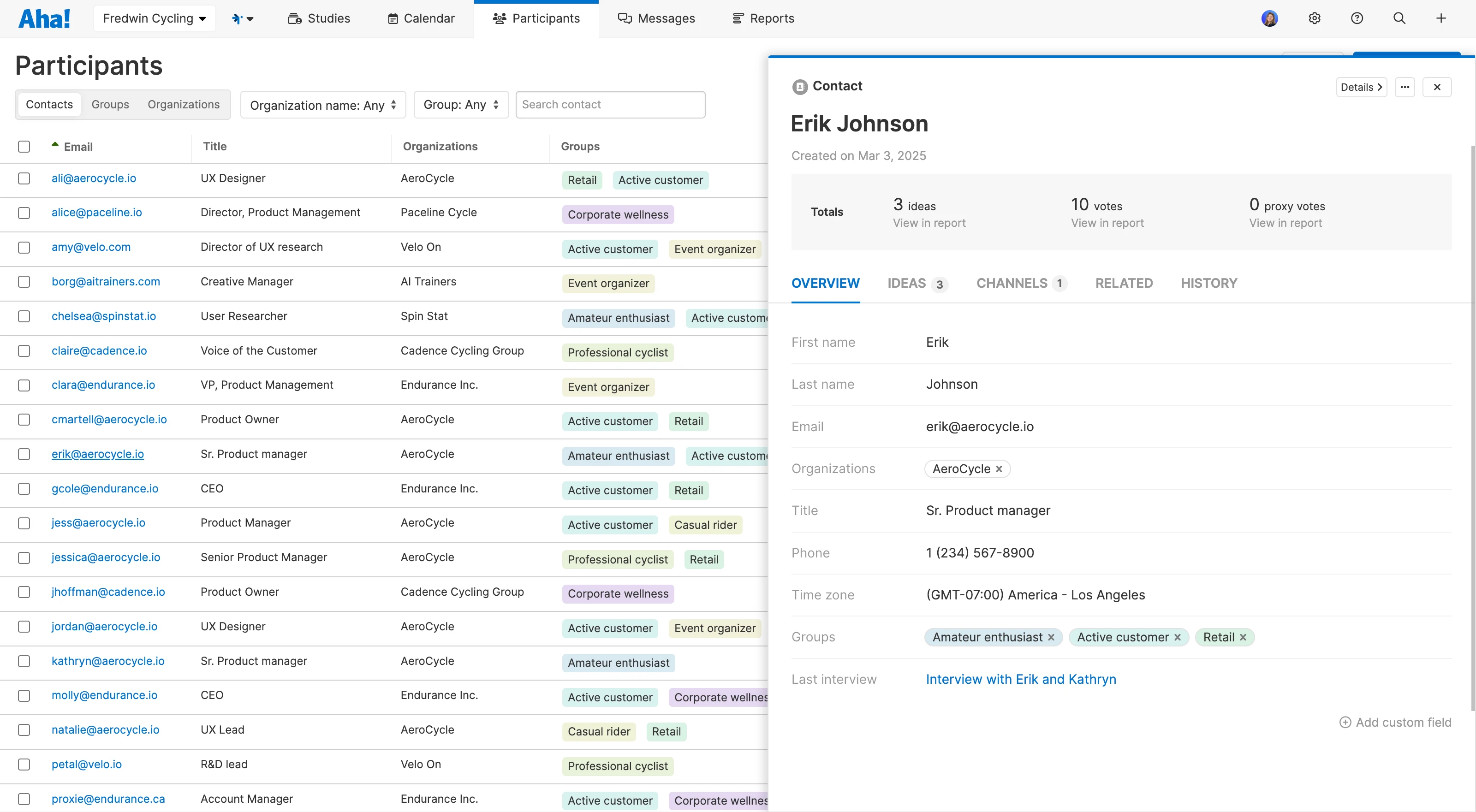

The Participants page in Aha! Discovery is where you see all your customers in one place — and quickly find the right people for research.

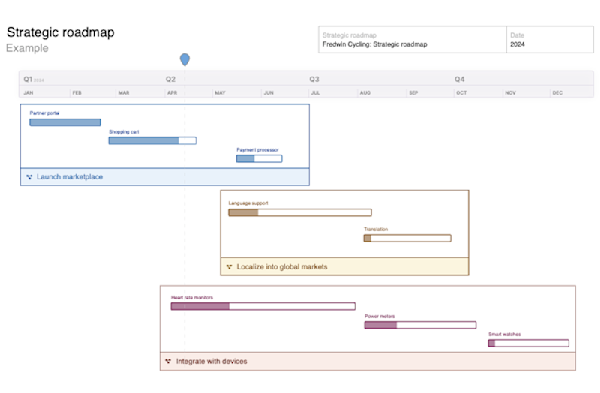

This guide will show you how to set up that system. Whether you are just getting started or want to scale your research program, a structured database makes it easier to find the right participants and tie research directly to your product roadmap. (You can also explore our comprehensive knowledge base, which gets into all the tactical details around how to build and maintain a customer database in Aha! Discovery.)

To skip ahead, use the links below:

What is a customer database for discovery?

You may already have a CRM packed with useful customer information, including account history, purchase data, and support interactions. That is great for managing relationships. But when it comes to product discovery, you need more than account-level data.

A customer research database is designed to support qualitative discovery work. It helps product and UX teams track who you have spoken with, know what was discussed, and organize what you learned — in a format that ties directly to product decisions and structured user interviews.

CRMs are built for interaction. Discovery databases are built for insight. The two are complementary, but not interchangeable.

Most product teams do not start from scratch very often. Your CRM is usually the first place to look when sourcing participants. But unless you log interview history and tag insights by theme, key context gets lost.

A customer research database (also called a participant database) gives structure to your discovery work. It brings everything into one place so you can stay organized, share context across teams, and avoid repeating the same questions to the same people — a major benefit when managing a user interview panel.

Pro tip: Aha! Discovery is designed to work alongside your CRM. If you have contacts stored in a spreadsheet or CRM tool, you can easily import them into your Aha! Discovery workspace.

Why a customer database is essential for product discovery

Discovery only works if you can find the right customers to talk to and keep track of what they tell you. Without a clear system for organizing participants and insights, research stays ad hoc. Teams fall back on familiar names, insights get lost, and big decisions are based on gut feelings rather than evidence.

It is not for lack of effort. Most product teams care deeply about customer input. But even with the best intentions, fragmented processes lead to fragmented insights.

Here are a few key benefits of using a customer database for your discovery work:

Brings structure to research: Makes it easier to plan studies, manage your interview panel, and revisit past conversations

Reduces research fatigue: Prevents overengaging the same customers and broadens the research pool

Improves collaboration: Keeps discovery aligned across product, design, and support — so everyone sees the same context

Minimizes bias: Ensures you hear from a diverse group of customers, and not just the loudest voices